Design is action, and action is the difference.

While it was noted that an evaluation of this work would not focus on formatting and presentation, FHC as a service/product is premised on action: the provision of information alone has proven less effective than information coupled with an undertaking.

In this spirit of action — which is a principal tenet of my professional philosophy — I determined to design my vision for scaling FHC instead of simply describing it. It's a first pass, unrefined, and in that regard, unvarnished; but I believe it does something more to communicate a plan for scale than text alone. I benefited from and integrated lessons from deeper reading on the history of FHC, as well.

What's in this document?

Section 1 answers Assignment No. 1, namely a brief account of an innovative idea I can say I own conceptually. Section 2 answers Assignment No. 2, namely a link to an article on human behavior that I find interesting. I provide two links — one that is relevant to scaling FHC, and another I find significant on a wider level. Finally, Sections 3a, b and c speak to Cashcare (healthcare for liquid capital), a suggested solution for scaling FHC. This concept is disconnected from the distinct Indian project of the same name.

For the love of ideas.

Over the years, I have had many ideas I wish I had the time and resources to pursue: long-range wireless transmission of electricity; an online writing community that deploys CC0 licensing to drive the propagation of members' works (I worked with Mikael Cho on the earliest iteration of Unsplash, and then kick-started this concept with his input — a capable team now holds the reins); or a GitHub-like platform for citizen-led petitions (this idea reached no. 8 on the font page of Y-Combinator's widely read Hacker News site, generating over 19,000 page views in a 24-hour period). I continue to admire the fantastic ideas of others as well, for example Be My Eyes.

A new bank-client relationship — fixed margin.

There's one idea, however, that specifically came to mind as I worked through the FHC case study. It's not a most innovative idea, but it struck me as perhaps most relevant. Back in 2013, I was contracted by an undisclosed bank to help them conceive and design a new service/product for a modernized spin-off. In that process, the bank's team was intently focused on one concept I developed in particular:

Program design.

The Financial Health Check (FHC) is a free, voluntary one-hour financial counseling session that takes place at a bank branch. Unlike traditional financial literacy programs, the principal goal of FHC is to pair information with action — persuading clients to sign up for automatic savings transfers and/or bill payments at the site of education. FHC was designed to close an intention-action gap that traditional financial counseling programs have failed to effectively bridge. It showed statistically significant results in savings, debt reduction and credit score improvement. There are three key behavioral facets of FHC:

- Creating a moment that fits into people’s lives

- Facilitating follow through in real time

- Automating savings

Low uptake.

Clients were solicited by mail and telephone. The overall response rate was 2%, though 15% of those reached by telephone agreed to partake. There was a 35% no-show rate. In sum, 175 out of 25,000 people received a FHC — only 7/10 of 1% of those solicited. On top of that, only 15% of those that did attend actually signed up for automatic savings transfers, bringing the program's intended effects to only about 25 people, or 1/1000 of the group initially contacted. A meta-analysis of similar projects may reveal this is an unacceptable rate of uptake.

Modes of resistance.

There were several forms of resistance to the program itself:

- Retention and availability of financial coaches proved challenging

- Clients were not frequently enough persuaded to sign up for automatic transfers

- Many clients did not respond to outreach, or did not show up to the FHC appointment

More broadly.

Moreover, the multifaceted demographic that struggles with saving faces broader impediments:

- Busyness masked as forgetfulness

- Limited self-control

- Difficulty accessing accounts

- Administrative burden

- Cognitive overload

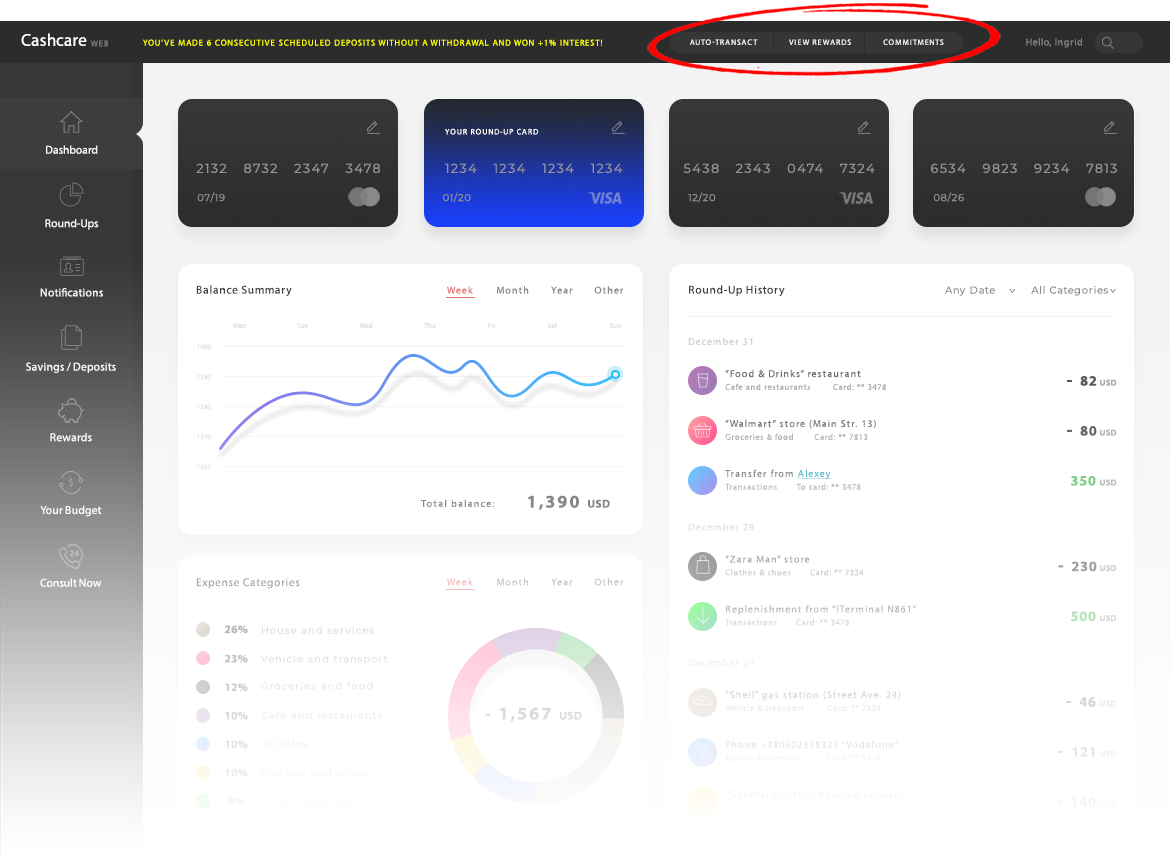

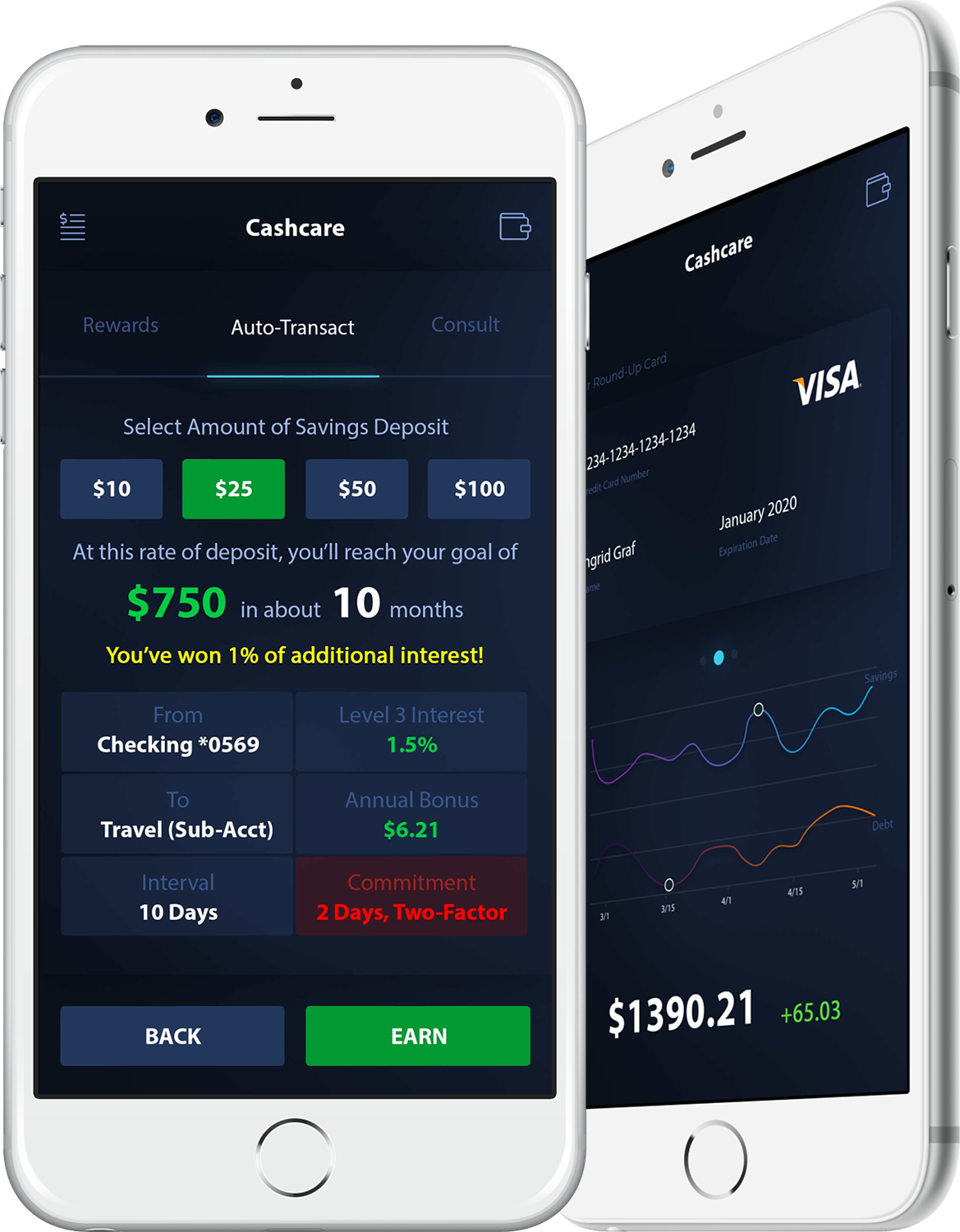

A feature-laden platform for improving financial health.